Investing is Hard

My first day at Sequoia was October 1, 2010. In that same week, I moved from Las Vegas to the Bay Area, hung my shingle at Sequoia, and Atticus was born.

Fourteen years at Sequoia has been the longest and the shortest time I’ve spent at a company. Time has its own reality distortion field. If you are a parent, you know the phrase: the days are long, but the years are short. If you work in technology, you have seen accelerating change since you entered the industry. If you have a few years behind you, you might have felt that every year gets shorter. That’s because, for a 2-year-old, a whole year is 50% of their life experience, but the same year is 2% for a 50-year-old. Additionally, even with years of experience, it feels new and exciting in a world of constant change.

Before my fourteen years at Sequoia, I spent fourteen years as an entrepreneurial operator. In the past, I had been saying I am a better operator than an investor because I have more years under my belt as an operator than an investor. That’s no longer true, and my operating experience is dated, so I have no choice but to make it as a venture investor.

Fourteen years is sufficient time to evaluate the quality of decisions and the outputs. You can create all sorts of scorecards and analyses and benchmark them against others in the venture industry, but this leads to a very insular point of view. Looking outside, what does being an accomplished investor mean more broadly?

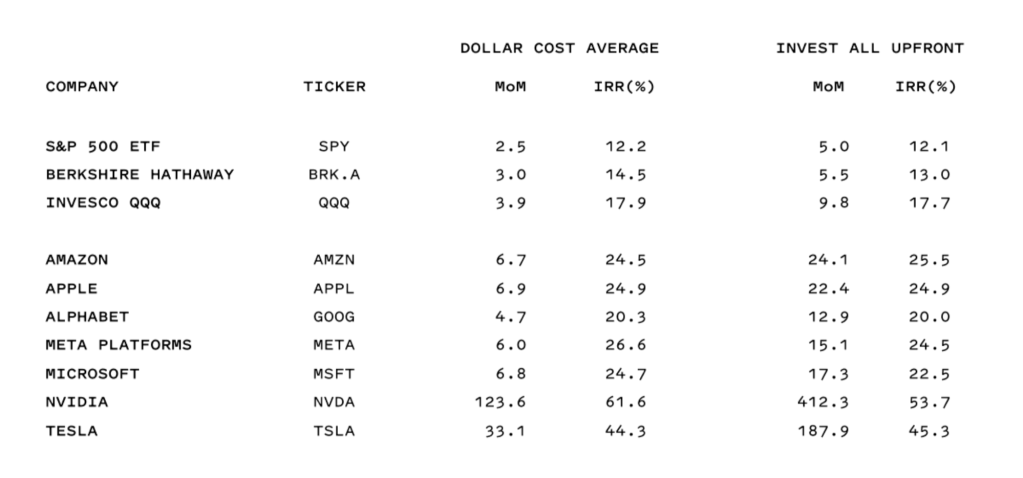

Our limited partners are not limited to investing in venture funds or even technology companies. To that end, we looked at investment performance for the S&P 500 Index, Nasdaq 100 Index, Berkshire Hathaway, and the individual stock performance of the Magnificent 7 from October 1, 2010 to October 1, 2024.

We looked at investing the same amount each day at the closing prices of October 1, 2010 (or for META on their IPO date of May 18, 2012) through October 1, 2024. We also looked at investing upfront at the closing price on October 1, 2010 (or for META on their IPO date) and holding until October 1, 2024. This analysis ignores dividends, as most technology companies and Berkshire Hathaway do not issue dividends, so it slightly understates the performance of SPY and MSFT.

We are fortunate to work in technology. Technology has outperformed the S&P 500 Index and Berkshire Hathaway during this timeframe. Technology has been influential for a long time and continues to see accelerating change. The reason is that the technology industry has continued reinventing itself and broadened its reach. The retail sector could have invented e-commerce, but it didn’t, and Amazon wanted to be part of the technology industry rather than a retail business. The automotive industry could have built electric cars, but it took an outsider to the industry to create Tesla. Yet, some have fought against technology ever since the printing press to no avail. Some aspects of technology require review, monitoring, and regulatory oversight, but those who fight against technology find themselves on the wrong side of history.

Many of us greatly admire Warren Buffett and Charlie Munger. They have taught us so much about consistent compounding, playing the long game, and the elements of a great business. Berkshire Hathaway’s market cap is approaching a trillion. Buffett and Munger wonderfully encapsulate investing wisdom in pithy mottos. While we should listen carefully, we should not take everything at face value. While BRK.A slightly outperformed SPY, it underperformed QQQ. This was due to Buffett and Munger’s stances that they like to own businesses that do not change much, where a monkey can run it because, eventually, a monkey will. This led them to avoid technology in general, and when they did invest in technology, it was in boring and dated businesses such as IBM and Cisco. Their approach was to be consistently not stupid, rather than reinvent themselves and be consistently smart, as does the technology industry.

We make the most money when we are right and contrarian. If we are right and consensus, since everyone knows about it, we will make some money, but if we are right and contrarian, we should be able to make a lot of money. Some people focus only on being contrarian, but being contrarian and wrong means we will lose money and look stupid. Being consensus and wrong, we will lose money and find safety in numbers, but what is the glory in that?

An example of consensus and right is winners keep winning. Magnificent 7 was coined in 2023, but each of the seven companies had been winning for a long time. From 2010 to 2024, every one of them outperformed the Nasdaq. With a greater than 20% IRR, every company also outperformed the venture industry over that period. In addition, since these companies are publicly traded, you don’t have to worry about distribution to paid-in capital (DPI).

An example of consensus and wrong was the Facebook IPO, nicknamed “The Faceplant.” So many investors dumped the IPO shares as the IPO was a “disappointment.” However, if we had invested at the closing price of $38.23/share, less than a quarter above the issue price of $38/share, on May 8, 2012, and held, we would have made 15.1x and had a 24.5% IRR through October 1, 2024 (and more since). This investment opportunity, or better, was available to anyone for over a year, as the stock traded below the issue price until August 2013. We had a whole year to study and develop the right and contrarian investment thesis!

Today, it is not surprising that NVDA and TSLA are among the best public investments of the last decade. More surprising is that if we had the right and contrarian investment thesis about accelerated computing or electrification fourteen years ago, NVDA and TSLA would have been among the best venture and growth investments of that time, with only a handful of private companies that would beat the 412.3x and 187.9x returns, respectively.

Over the last fourteen years, I have been told that being an investor is challenging and humbling. Reflecting on my fourteen years at Sequoia and this analysis, investing is hard, but we remain undeterred and keep pushing forward toward our goal of being the world’s top-performing investment partnership.