Less is More

At Zappos, we had ten core values. The first and most celebrated core value was: Deliver WOW through Service. Many books, blogs, and case studies have been written about Zappos’ culture of service and this core value. Many of our other core values guided how we operate, but the lesser known core value #8 is the only one that ensured Zappos was a competitive and successful business: Doing More with Less. Without a successful business, no one would write or read about Zappos.

It is hard to believe that this important core value was almost excluded from the final slate because it was considered too pedestrian and materialistic. We were fortunate to have Michael Moritz present at the board meeting when we presented our core values. He listened carefully, ripped out a half sheet of paper from his notepad, and scribbled with a fountain pen: Profit = POWER. Michael slipped the paper across the table right before leaving the meeting. Mic drop.

Every business needs to do more with less every year. Still, it took several Adapt to Endure sessions and a much more difficult financing environment for most of our companies to put this concept into practice. Before the financing downturn, most of our companies were doing more with more. When capital was plentiful, we often heard from founders that they believed capital was a strategic weapon, forgetting that capital is fuel but not a moat.

Truthfully, even Zappos primarily abided by doing more with more rather than doing more with less. It is easier to invest more and grow more. It is much harder to invest less and grow more. It requires prioritization of the most important things, focusing on the work that matters, consistent compounding, and, the hardest part, cutting out all other distractions.

In times of plenty, we justify that doing more with less is too hard. In our current environment, we have no other choice. Out of necessity, we somehow find a way. Through the obstacles of harder financial times, our founders and companies develop their cost advantages, which Roelof has pointed out can become competitive advantages.

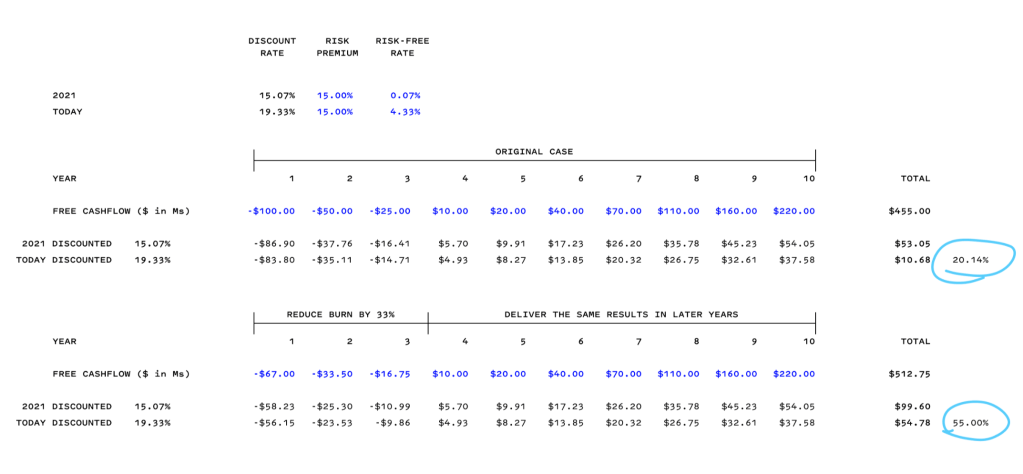

Last week, we showed an example of discounted cash flows today are worth only ~20% of what it was worth in 2021. This week, we expand on that example by reducing the investment amounts in the first three years by 33% but keeping all future cash flows the same:

This new cash flow stream in today’s interest rate environment is worth approximately the same as the original cash flow stream in 2021’s environment. Furthermore, the new cash flow stream is worth ~5x the original stream in today’s environment and ~2x in 2021’s environment. Yes, these are toy examples, and the differences are more extreme in a higher-interest environment, but let’s not forget that a more efficient business is better in all environments.